COVID-19 Impact in Japan

Japan is one of the few countries where coronavirus spread immediately after it was discovered in China. The first case of COVID-19 in Japan was detected on 16 January 2020 and since then the total number of cases have exceeded 13,300 as of 26 April. The Japanese government has declared a state of emergency as a measure to curb the spread of the COVID-19 but a strict lockdown has not been implemented like in other countries. The advice given to the residents is to restrict their movement from home to work only. Higher attention is being given to these seven regions – Tokyo, neighbouring Chiba, Kanagawa and Saitama, the western hub of Osaka and neighbouring Hyogo, and the southwestern region of Fukuoka. Despite not implementing strict movement control in Japan, the educational institutes were shut down since March 6, 2020.

Like all other countries, COVID-19 has changed the daily activities of the Japanese residents although the government has not imposed a strict lockdown, fears of getting contracted by the disease have deterred the public from going out. This, in turn, has severely affected the tourism sector which has seen a massive decline as inbound flights have been cancelled. Coupled with the stringent health check-ups at the immigration entry stations, the number of tourist arrivals has fallen tremendously as the pandemic showed few signs of abating.

This scenario has had an impact on the oils and fats intake in Japan particularly in the HORECA and food sector. As reported in the USDA report, due to fewer people eating out and the reduced number of tourists, major distribution channels such as restaurants, hotels, institutional food service (schools and workplaces) and department stores have registered a decline in sales between 10 to 60 per cent. Many restaurants and department stores were closed due to these drop-in customers patronizing their outlets leading to lower sales. However, major distribution channels such as supermarkets and convenience stores have shown an increase in their sales by 20 to 30 per cent. This increase is due to the preference of the Japanese to eat at home which has led to most population shopping form supermarkets and convenience stores for their usual grocery items including oils and fats.

Palm Oil Scenario

Japan is among the biggest importers of palm oil in the region. Japan’s palm oil import has increased significantly from 598,500 MT in 2014 to 778,600 MT in 2019. Malaysia and Indonesia are the main exporters to Japan. Malaysia dominates 65 per cent of the market share followed by Indonesia at 35 per cent. Japan is one of the major destinations for Malaysian palm oil. In 2019, the total Malaysian palm oil export to Japan was at 498,359 MT. However, based on USDA (FAS/Tokyo) estimates in MY 2019/2020 (Marketing Year: Oct to Sept) vegetable oil consumption will fall by 2.5 per cent due to the COVID – 19.

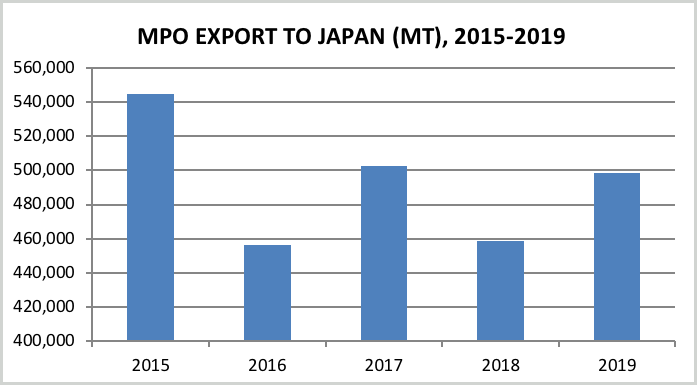

Chart 1: Malaysian Palm Oil Export to Japan 2015 – 2019

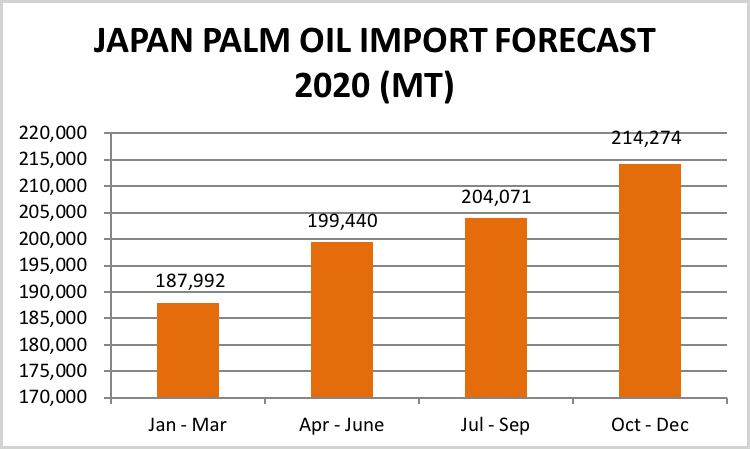

From the chart above, MPO exports to Japan have been at an average of 492,167 MT per annum since 2015. Whether the COVID-19 pandemic may or may not affect MPO export to Japan is subject to speculation but since Japan’s consumption of palm oil is not limited to food sector only but has expanded to non-food sectors, there has been an increase in demand for palm products such as stearin in their energy sector specifically in their biomass plant. The demand is expected to grow as Japan is looking forward to accelerating the adaptation of renewable energy and this is evidenced in the setting up of the first palm oil power plant which was open in 2014. Currently, 10% of Japanese electricity is from renewable energy and in their Fourth Strategic Plan, they set the renewable energy share target at 24% by 2030. Also, 15 per cent of palm olein is used to produce detergents, soap, cosmetics, etc. There is a strong possibility that the demand for cleansing products will increase due to COVID-19 as many of these products are palm-based which may lead to an upward trend for palm olein as well. Based on the forecast below, we are expecting increases in Japan’s palm oil import in 2020.

Chart 2: Japan Palm Oil Import Forecast (MT) 2020 by Quarter

MPO Demand and Conclusion

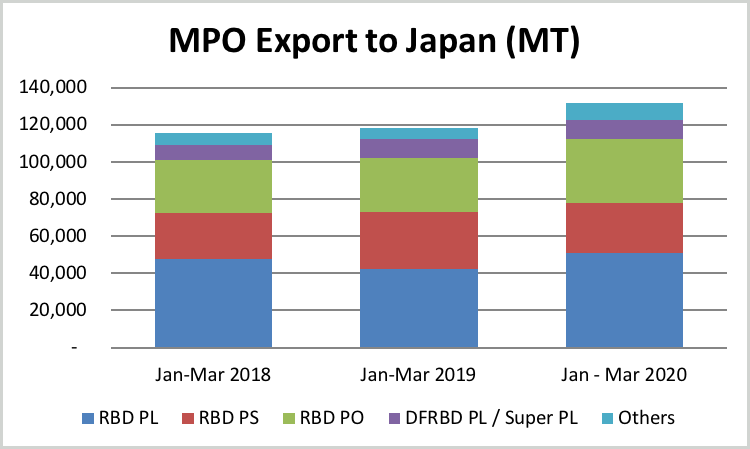

MPO exporters have forged a good business relationship with their Japanese counterparts to ensure MPO has a strong demand in food and non-food industries in Japan. Referring to the latest MPOB statistics there is a slight increase in the export figure for March this year (131,595 MT) compared to the same period last year (118,197 MT).

Chart 3: Malaysian Palm Oil Export to Japan, Jan-Mar 2018, 2019, 2020

Malaysian palm oil will continue to have a very strong demand in Japan and Malaysia must ensure that this position as the market leader is maintained. To do so Malaysia needs to explore new potential sectors for palm oil in Japan, particularly the renewable energy sector as one of the potential sectors. The Japanese government is looking very seriously to expand its Renewable Energy initiatives to comply with global standards.

Despite the COVID-19 which has forced people to change their lifestyle, industries such as food and oleochemical are showing steady growth. Home eating will become the new norm and the Japanese people who traditionally practice cleanliness as a habit will see an increase in awareness of hygiene. These two factors among others will be the main reasons for the increasing demand in packed and process foods as well as oleochemicals. Looking at this scenario it is expected palm oil demand in Japan is set to show positive growth despite the adversarial challenges.

Prepared by: Muhammad Kharibi

Article’s Source: USDA Foreign Agricultural Service

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.